Auto insurance is one of the most important things a driver can purchase. Although you hope to never have to use it, you will be glad it’s there should the need arise. Before that happens, though, there is no reason you shouldn’t be able to find the best deal possible.

Figure 1: Car insurance is required in nearly every state and should be carefully considered. Source: Forbes.com

If you have been trying to find out how to find the best auto insurance deals online, you may have been overwhelmed by the choices. Auto insurance is a huge industry that is also highly specialized to the individual. Not all auto insurance companies are created equal and each driver’s situation is different.

In this post, we will cover the different factors that come into play when searching for the best auto insurance deals online. By understanding how these things will affect your insurance rate, you can find the best deal for your driving habits and needs.

Source: TheHartford.com.

What Makes a Great Auto Insurance Deal?

Finding the best auto insurance deals online will be based on individual rating factors such as driving history, type of automobile and even your credit. Each company will weigh these factors differently, which will determine your rate. This is why it is so important that you compare rates and don’t settle on the first company that gives you a quote.

Figure 2: Good insurance is not only a legal requirement, it can end up saving you big money if you find a good deal. Source: AdvantageInsAgents.com

You are also going to want to look at what each insurance deal offers. The more coverage you need, the more expensive your yearly premium is going to be. This premium is spread out over the course of 12 months. Divide that premium by 12 to figure out what you would be paying monthly.

CLICK HERE TO WATCH A VIDEO ON 11 WAYS TO GET CHEAPER CAR INSURANCE RATES.

We spoke to an insurance agent at Geico.com who told us that “your yearly premium is determined by things like your age and where you live. That usually can’t be changed but there are a ton of discounts available. One example is your safe driving record. The longer you go without having any accidents, the cheaper your premium is going to be.”

Source: Kiplinger.com; Geico.com; Interview with Geico agent conducted 10/19/2020.

What Factors Determine a Great Auto Insurance Deal?

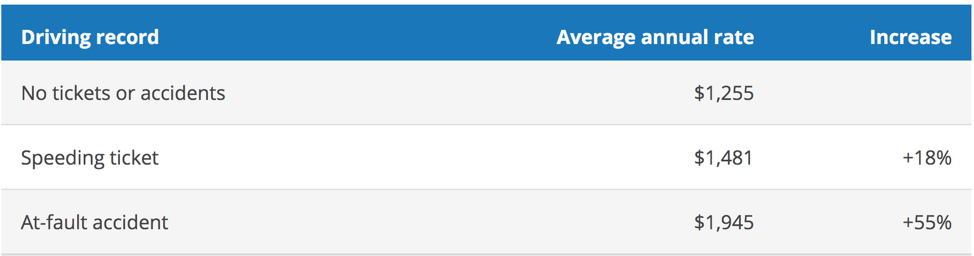

Driving Record

Figure 3: Your accident history will be a huge factor in how much a provider will charge you for your premium. Source: QuoteWizard.com.

Your driving record has the most to do with how expensive your premium will be. People with speeding tickets pay an average of 18% more for auto insurance. Going even further, people who have been at fault in accidents pay up to 55% more.

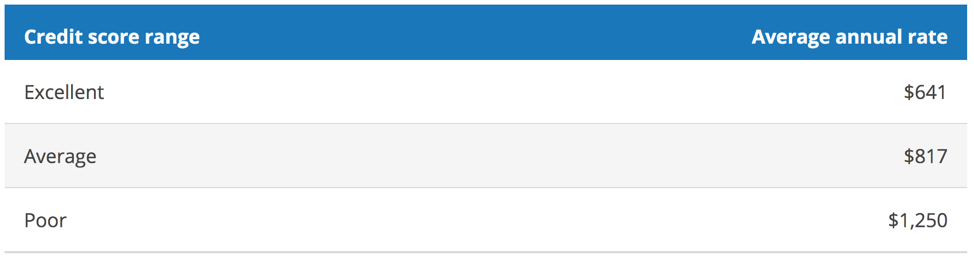

Credit Score

Figure 4: Credit score has as much to do with your premium price as your driving record and age. Source: QuoteWizard.com.

You may not think your credit score has anything to do with how much you pay for insurance. However, people who have excellent credit will pay nearly half as much for auto insurance than people who have poor credit.

Coverage

What type of coverage you have will be another huge factor in what you pay. The most basic coverage will be about half as much as some of the more premium insurance packages. However, depending on what kind of driver you are and what your area is like, you may want to spend a little bit more money in order to be fully covered.

Home Ownership Status

Believe it or not, whether you own or rent your home will be a determining factor in your insurance premium. People who own their home will pay, on average, half as much as those who rent their home. All providers take this into consideration so it is important that you give an accurate account of your home ownership status.

Source: Allstate.com; QuoteWizard.com.

What is Included in a Great Auto Insurance Deal?

Almost every state in the U.S. requires you to have some sort of insurance for your automobile. Even the most basic auto insurance deals online will include liability coverage that will keep you compliant with the law on the road.

Figure 5: Accidents happen, so it is best to have the most coverage that you can afford to make sure you won’t be personally liable. Source: NerdWallet.com.

The coverages required by law include, but are not limited to:

Bodily Injury Liability

This covers costs that may arise from injuries or deaths that might occur due to an auto accident. It is imperative when searching how to find the best auto insurance deals online that you make sure Bodily Injury Liability coverage is included.

Property Damage Liability

This will cover any damage to property that stems from accidents on the road. This could be damage to other cars, homes, or anything else that you might not be able to pay for were it not for your auto insurance.

Depending on your state, you may also be required to have the following extra coverage in your auto insurance policy:

Personal Injury Protection (PIP)

This coverage will pay for medical costs or even lost wages associated with an automobile accident. It covers the driver as well as any passengers in the car as well. In the event of an accident where an injury occurs, this is incredibly important coverage to have.

Figure 6: The people in your car are just as in need of insurance as the car itself. Source: MarketWatch.com

Uninsured Motorist Coverage

If you are involved in an accident where another motorist is at fault, their insurance is supposed to pay for the damages and medical costs. However, if that driver does not have insurance, you could find yourself stuck paying those damages. This is why Uninsured Motorist Coverage can give you some great peace of mind.

Sources: ShouseLaw.com; MattLaw.com.

Places to Find the Best Auto Insurance Deals Online

The easiest way to find the best auto insurance deals online is to compare quotes. Insurance companies will ask for information regarding your driving habits and history and will then offer a quote. Make sure that you are giving all the companies accurate information to ensure that you are getting a quote that is accurate and includes the coverage you need.

CLICK HERE TO WATCH A VIDEO ON THE BEST WAYS TO COMPARE CAR INSURANCE QUOTES.

We have put together a shortlist of places to start when figuring out how to find the best auto insurance deals online. With this list, you can start comparing quotes and finding the deals that will offer you the most coverage without completely breaking the bank every month.

Source: AutoInsurance.org.

1. QuoteWizard.com

QuoteWizard is designed to help people navigate the confusing world of auto insurance. They understand that many people are just trying to make sure they are compliant with state laws while trying to get the cheapest premium possible.

They will allow you to sort quotes based on your state, coverage level, and other factors that will determine your eligibility for a cheaper premium. It is very important that when you are comparing quotes, you make sure that the coverage level is the same for all the companies.

Your accident history has a huge impact on your insurance premium. According to QuoteWizard, people who have at-fault accidents on their record pay an average of 55% more for their insurance yearly.

Source: QuoteWizard.com.

2. Insurify.com

Insurify specializes in getting you the most accurate quotes in the least amount of time. Should you decide to compare insurance quotes manually, you could be looking at hours and hours of work. By working with a quote comparison site like Insurify, you can get all of your quotes in one place.

They will ask you a number of questions in order to determine what kind of coverage you will need and the prices you are eligible for. These questions will include things like your credit score, your gender and your marital status. All of these factors will be taken into consideration when you receive your quote comparison sheet.

One of the major benefits of having your quotes gathered by a third party is the lack of spam. Many times, getting a quote from an insurance company requires you to enter sensitive personal information. By comparing quotes with Insurify, you can avoid handing out your email address to a dozen or more different companies.

Source: Insurify.com.

3. TheZebra.com

The Zebra is specifically designed to be as simple as possible. They make the process user-friendly and easy to begin without a big commitment. Their website has a bold and simple interface that is easy to understand and doesn’t throw a lot of information at you at once.

They also gather information from over 100 providers around the country. When comparing quotes, the best thing to do is be as thorough as possible. The more providers you look at, the more likely you will be to find the best auto insurance deals online.

You will have to provide information to The Zebra such as what type of car you own and some personal information in order for them to utilize your driving record. This is how they gather quotes and ensure that you are getting the kind of coverage required for your state and suggested for your driving habits and record.

Source: TheZebra.com.